Recently, a heavyweight piece of news has drawn intense attention in the global mining market: Rio Tinto and Glencore are in contact regarding a potential acquisition or merger. Although no definitive transaction plan has been disclosed, if completed, the deal would give birth to a new global mining titan with a market capitalization approaching or exceeding US$200 billion, reshaping the global mining landscape in terms of scale and influence.

Picture:Rio Tinto and Glencore; Source: Mining Magazine.

The reason this merger discussion has sparked such broad debate is not only its sheer size. Against the backdrop of the energy transition, electrification, and the accelerated build-out of AI infrastructure, copper, nickel, lithium and other key metals are shifting from cyclical commodities to core resources with long-term strategic attributes. The capability to secure these metals is increasingly becoming a key competitive edge across global industrial supply chains.

01 Two World-Class Mining Platforms Are Converging

Rio Tinto

Founded in 1873, Rio Tinto is one of the oldest and largest mining companies in the world, dual-headquartered in the UK and Melbourne, Australia.

Listings

-

London Stock Exchange (LSE): Rio Tinto plc (RIO)

-

Australian Securities Exchange (ASX): Rio Tinto Limited (RIO)

-

New York Stock Exchange (NYSE, ADR): RIO

As of recently, Rio Tinto’s market capitalization stands around US$130–145 billion, ranking among the top global mining companies over the long term.

Core asset footprint

-

Iron ore: Core assets concentrated in the Pilbara region of Western Australia — one of the world’s most important and lowest-cost iron-ore belts.

-

Copper: Holds world-class copper assets, including Oyu Tolgoi (Mongolia), widely regarded as one of the most important copper mines globally in recent decades.

-

Other metals: Bauxite, alumina, aluminum, gold, diamonds, and—more recently—resources aligned with electrification and energy transition.

Picture:Rio Tinto’s operations in Western Australia; Source: Rio Tinto.

Glencore

Founded in 1974 and headquartered in Switzerland, Glencore is one of the few groups worldwide that simultaneously possess large-scale mining production capacity and a global commodities trading network.

Listings

-

London Stock Exchange (LSE): Glencore plc (GLEN)

-

U.S. ADR/OTC: (Some platforms display GLNCY / GLCNF)

At present, Glencore’s market capitalization is roughly US$65–72 billion. Although smaller than Rio Tinto in scale, it wields significant influence in certain metals and energy commodities.

Core minerals and businesses

-

Copper: Significant assets in Peru, Chile, and the DRC, among other locations.

-

Zinc, nickel, cobalt: Leading global production and resource reserves across base-metal segments.

-

Coal: One of the largest listed coal producers (thermal & metallurgical).

-

Commodities trading: Covers energy, metals, and agricultural products — a central hub in global commodity markets.

Picture:Rio Tinto’s operations in Western Australia; Source: Rio Tinto.

In short: Rio Tinto represents “scale + low-cost advantages,” whereas Glencore represents “resources + global trading-network amplification.” If the two truly join forces, the impact would extend beyond industry concentration to a re-shaping of supply chains and pricing power in global metals.

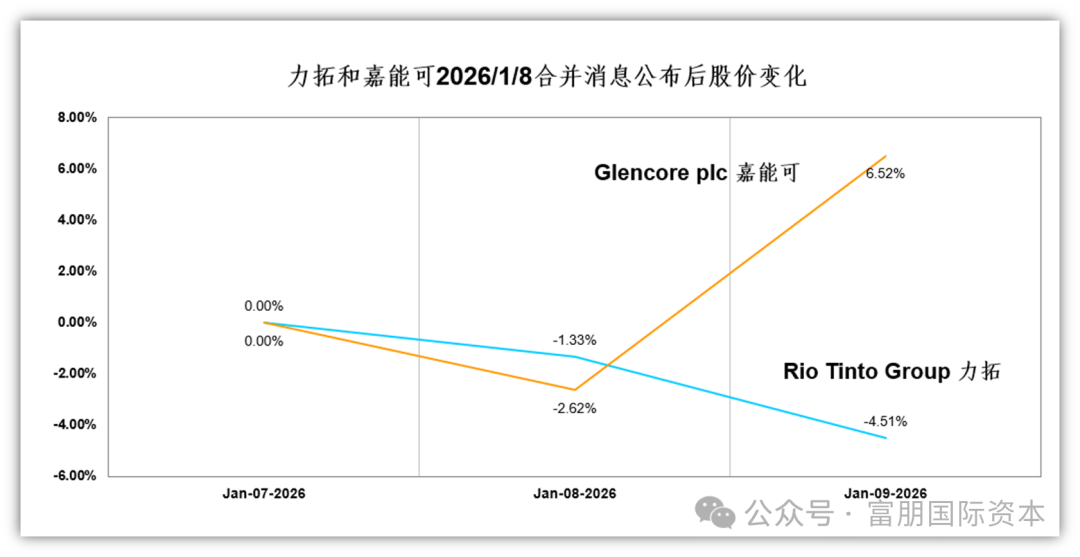

02 Market Reaction — The Recurring Pattern in M&A

In acquisition announcements, the market’s reaction to the buyer and seller is almost never symmetrical. A long-observed and repeatedly verified pattern is: the acquirer’s share price tends to fall, while the target’s share price tends to rise. In this event, the pattern has been particularly clear.

For the acquirer, the market’s primary focus is not the “story,” but the most practical question: Does the deal create value? Acquisitions imply integration costs, overall cost of capital, complexity of integration, and increased uncertainty of execution quality. Even if the transaction appears reasonable strategically, the market often maintains a conservative stance before clarity emerges on the discounted-cash-flow impact. Hence the market tends to wait for the signing and closing milestones rather than reacting purely to the announcement itself.

For the target, the situation is very different. Once the market anticipates that a company may become a takeover target, investors need not wait for answers to “whether a deal can be signed.” In acquisitions, the buyer almost always needs to pay a premium over the current price — a control premium or exchange premium. This premium and the deal price (in theory) should be higher than the market price at the time of the announcement, and the rally in the target’s stock essentially reflects the market pricing in the expected premium.

03 “Copper” Is Driving This Potential Deal

From an industry perspective, the most fervent and active topic this year is copper — and, unusually, the logic behind it is highly consistent across sell-side research.

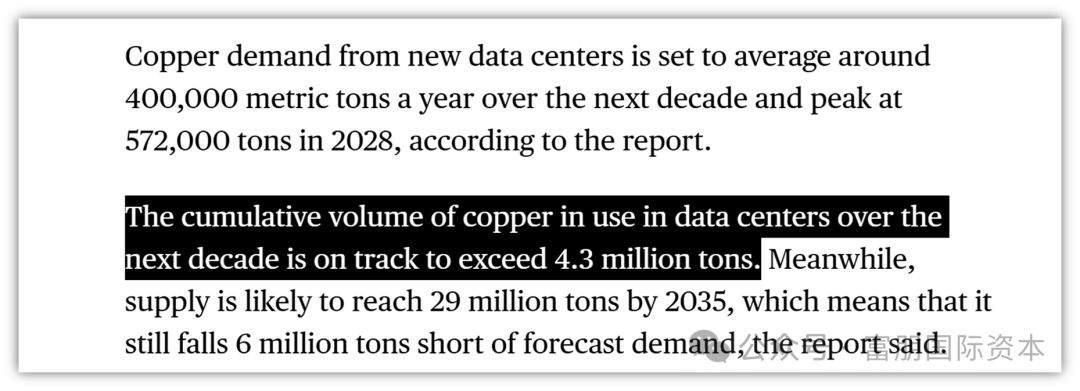

AI data-center build-out is re-shaping the demand structure for copper

AI models and compute-infrastructure expansion have driven surging demand for power, cooling, and distribution systems, far beyond past capacity. According to sell-side projections, over the next 10 years, data centers alone could add about 4.3 million tons of copper demand — a change sufficient to reconfigure the market’s overall demand structure.

Chart: Sell-side estimates that, over the next decade, data centers alone will add ~4.3 Mt of copper demand; Source: Bloomberg.

Copper is transitioning from a cyclical commodity to a strategic resource

Under multiple demand drivers, copper prices have risen about 41% in 2025. Price performance has clearly outpaced most traditional industrial metals. More importantly, the market’s long-term valuation anchor for copper is shifting — from short-term demand fluctuations to anticipation of structural scarcity.

The time and cost of bringing new copper supply online are extremely high

From exploration and discovery to production, a single large-scale mine takes on average ~17 years. Under current environmental, permitting, and geopolitical constraints, this cycle shows no clear signs of shortening. For demand that has already been confirmed, accelerating supply via new-mine development entails long time frames and high certainty costs.

Chart: Historical average development cycle for large copper mines is ~17 years; Source: Mining Visuals.

Scaled integration is becoming a defensive option in the resource race

With the next decade likely to see the construction of AI-era infrastructure and electricity systems, mining groups with larger scale, broader geographic footprints, and stronger resource control will gain advantages in basic costs, supply assurance, and long-term pricing power. The choice to “secure core resources” is opening a new window for industry consolidation and M&A.

In this broader view, the question is no longer merely a company-level choice; it is a pre-emptive move in the race for scarce future resources and industry pricing power.

04 The Three Priorities of Rio Tinto’s New CEO

In mid-July 2025, Rio Tinto’s board announced Simon Trott as the new Chief Executive Officer (CEO), with formal commencement on August 25, 2025. Trott has 25+ years of experience at Rio Tinto and previously headed the iron-ore division, serving as one of the company’s most senior executives in core businesses.

Image:Simon Trott (right); Source: TM Partners.

From a strategic lens, his appointment is not a simple “continuity of course,” but a shift in several key directions compared with his predecessor — something the market sensed early on:

1) Emphasize “simplicity and efficiency,” compress costs, and raise operating performance

During Trott’s tenure leading iron ore, he pushed for operational-efficiency improvement, cost discipline, and partner-ecosystem management — which became a core rationale for his CEO appointment. In market terms, this is the “operating discipline” style, essentially a method of improving execution efficiency through lean management.

2) Clearer pivot in resource strategy

Trott’s past focus on internal value optimization is giving way to a more outward-looking resource strategy that includes safeguarding core iron-ore businesses while tilting toward copper. This is reflected in more active negotiations with peers on cooperation or consolidation, and in clearer positioning toward future-facing metals.

3) A more open posture and greater M&A optionality

Compared with his predecessor, Trott has shown greater “deal flexibility.”

-

This is reflected not only in openness to contact and negotiations with Glencore, but also in his integrative approach to evaluating synergies and long-term resource control. Such thinking aligns the valuation logic of traditional resource assets with that of future-oriented strategic assets.

-

With fewer constraints on deal rhythm and structure, Trott’s strategy appears more oriented toward large-scale transactions, searching for compatibility between market structure and asset-portfolio path.

In sum, Trott’s “three priorities” — improving operational efficiency, focusing on core resources, and enhancing M&A flexibility — represent not only Rio Tinto’s internal upgrades, but also the company’s proactive response to market-structure changes and the broader industry cycle. This is also the fundamental logic behind the potential occurrence of this “deal of the century.”

In 2024, Fupeng International has successfully completed five SPAC listings, setting an annual record for a single institution in the industry.

Enterprises with clear listing plans can contact Fupeng International for negotiation. With our cutting-edge capital structure design capabilities, we help innovative enterprises seize the historic opportunities in the SPAC 2.0 era.