On November 19, 2025, Pantages Capital Acquisition Corporation (NASDAQ: PGAC) and MacMines Austasia Pty Ltd officially signed a Business Combination Agreement (BCA), marking a critical stage in the listing process.

This cross-border mining de-SPAC transaction has been led end-to-end by FocalPoint Partners as MacMines’ exclusive financial advisor. The signing of the BCA represents a decisive step for MacMines toward the U.S. capital markets and reflects the successful integration—across cross-border structuring, legal systems, and regulatory processes—of a complex Australian resources project.

01 Rapid Progress Under FocalPoint’s Leadership

Under FocalPoint’s overall management and execution, the project took just five months from initial contact, to negotiation of key terms, to cross-border structuring, and finally to the official signing of the BCA.

For a complex Australian large-scale mining asset spanning three jurisdictions (U.S./Australia/China) and involving mining-tenement transfer and SEC disclosure, this pace is exceptionally challenging and rare in the industry.

Highlights at a glance:

Four core milestones completed in five months:

initial contact → LOI signed → pathway framework completed → BCA signed

-

Project valuation confirmed: US$180 million

-

Listing structure built: Australian SPV + Cayman PubCo

-

Boards of both parties approved unanimously

-

Post-combination company expected to list on Nasdaq

This speed fully demonstrates FocalPoint’s capabilities in planning, structural design, and multi-party coordination for cross-border resources transactions.

Pictured: News on the Pantages–MacMines combination; Source: ACCESS Newswire.

Pictured: News on the Pantages–MacMines combination; Source: ACCESS Newswire.

02 Core Challenges of an Australian Mining Project

MacMines is a typical Australian resources asset, and the project’s difficulties far exceed those of a standard SPAC combination:

1) Complex cross-border legal systems

The transaction must simultaneously satisfy:

-

Australian Corporations law and mining-tenement law

-

Australian land law and environmental regulation

-

U.S. securities law (F-4, SPAC rules, public disclosure)

-

Cayman Islands Companies law

The cross-border legal chain is long, regulatory differences are significant, and alignment is difficult. In addition, the project required collaboration among three U.S. law firms + two Australian law firms; FocalPoint unified terms, documents, and disclosure standards and drove the process forward.

Pictured: Government of Queensland website; Source: qld.gov.

Pictured: Government of Queensland website; Source: qld.gov.

2) Lengthy, tightly regulated mining-tenement transfer

The assets proposed for listing by MacMines are:

-

Mining Lease Application (MLA) — i.e., a mining-tenement asset still at the development-right application stage.

Before listing, the following had to be completed:

-

Build and transfer into a new Australian SPV

-

Prepare the full set of mining-tenement regulatory materials

-

Engage with Australian government agencies

-

Submit environmental assessments

-

Coordinate multiple legal and technical opinions

This type of “development-right application stage” asset is itself very uncommon, further increasing complexity in transaction structuring, disclosure language, and audit pathways.

3) Highly complex Australian tax compliance

The transaction involves:

-

Australian cross-border taxation

-

Cost basis and tax impact of MLA transfer

-

Australian corporate tax, CFC regime (similar to the U.S. Subpart F)

-

Transparency requirements under the SPV structure

-

Tax-optimal planning for the future PubCo

These workstreams required Australian tax counsel, U.S. securities counsel, and Australian corporate counsel to cross-confirm, representing one of the key technical challenges of the project.

4) U.S. public-company disclosure and audit readiness

MacMines had to complete—within a very short timeframe:

-

Align Australian local financial statements with SEC disclosure

-

Prepare the full suite of legal documents

-

Rewrite the regulatory disclosure language in transaction documents

-

Ensure compliance with U.S. mining disclosure standards

-

Rebuild board/shareholder governance systems

03 FocalPoint’s End-to-End Solution

Faced with a highly complex Australian resources project, FocalPoint delivered an end-to-end solution, ensuring progress to BCA signing within five months.

1) Precisely designed cross-border structure

FocalPoint led the design of a cross-border listing structure that aligns with Australian regulation and U.S. SEC requirements:

-

Establish the listing vehicle in Cayman (Cayman PubCo)

-

Establish an Australian SPV to hold the mining assets

-

Complete the final combination with the SPAC via a share-for-share model

-

Map the full cross-border legal chain and regulatory-compliance process

This ensures that, at its core, the transaction structure satisfies both Australian and U.S. regulatory requirements.

Pictured: 8-K disclosing the BCA signing; Source: SEC.

2) Coordinated regulatory and document system

FocalPoint coordinated multiple professional law firms in Australia and the U.S. to advance:

-

Mining-tenement transfer applications and legal opinions

-

ASA/SSA/LFA and other cross-border agreements

-

Australian board and shareholder approvals

-

Regulatory-language review for the full set of cross-border announcements and disclosures

This provided a solid foundation for compliance, accuracy, and enforceability of the transaction documents.

3) Efficient cross-time-zone execution

Spanning China, the U.S., and Australia, FocalPoint was responsible for:

-

Leading negotiations of all key terms from LOI to BCA

-

Orchestrating legal, audit, valuation, and mining-technical teams to execute in sync

-

Driving the disclosure pathway design and regulatory compliance

-

Managing the end-to-end workstream through successful BCA signing

This ensured high-speed coordination on a multi-team, high-technical-content cross-border project.

04 About MacMines

MacMines Austasia Pty Ltd (MacMines) is a geological exploration and mining company active in the Galilee Basin, Queensland, Australia, and holds one of the basin’s largest high-quality coal and energy resource projects.

Pictured: Mining areas held by MacMines; Source: MacMines.

MacMines’ resource portfolio is not limited to traditional coal development; its strategic focus has extended into competitive energy-transition pathways, including:

-

Developing a circular-economy industrial park using advanced clean-coal gasification technologies;

-

A long-term energy strategy to power AI and data centers;

-

A vertical value-chain plan of “coal → hydrogen → clean fuels / low-carbon industry.”

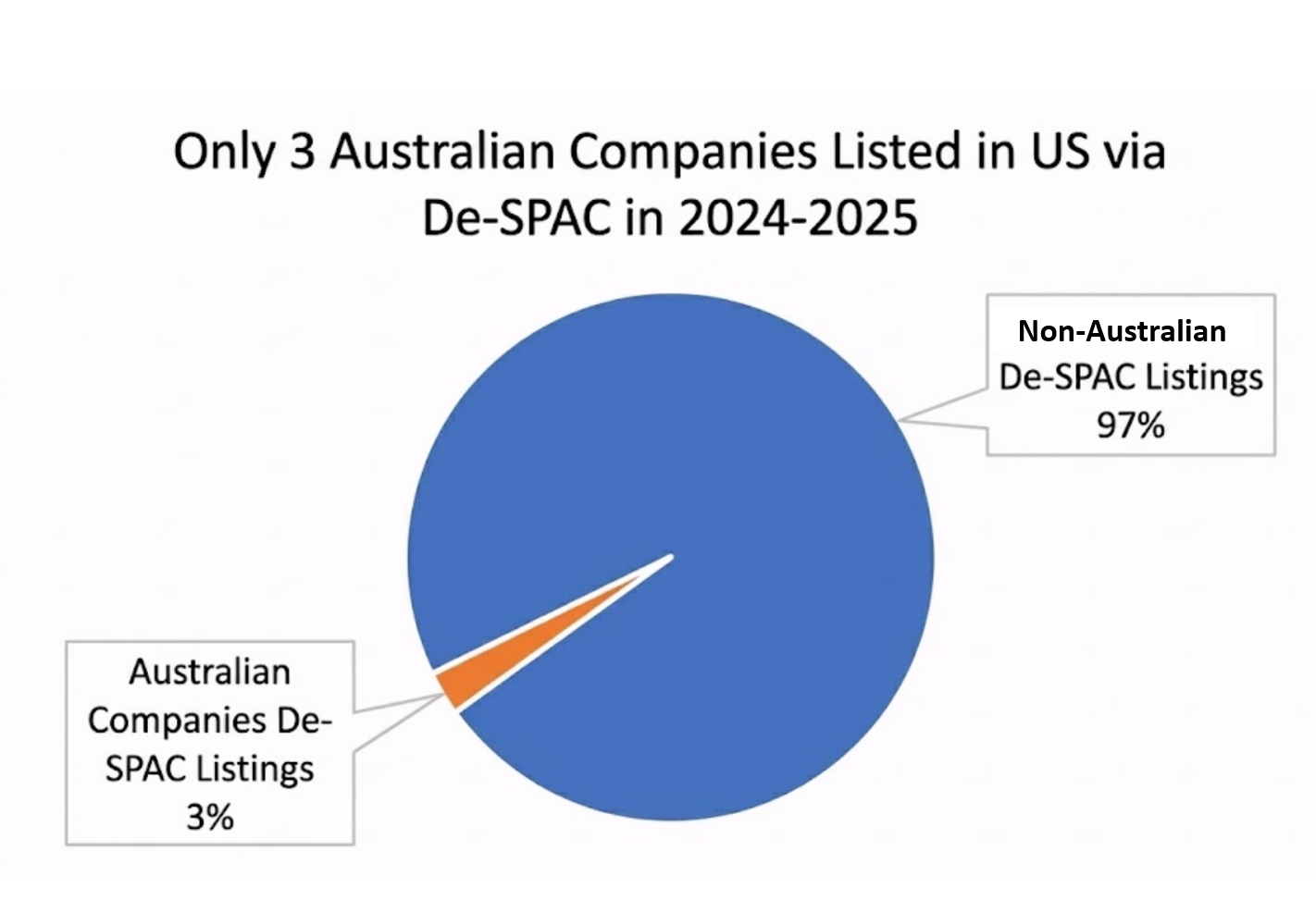

Over the past two years, 112 companies have listed in the U.S. via de-SPAC, of which only 3 were Australian—less than 3%.

This indicates that Australian companies pursuing U.S. listings via de-SPAC are extremely rare, with limited successful pathways, high execution complexity, and stringent regulatory requirements.

Pictured: Share of Australian companies among U.S. de-SPAC listings; Source: FocalPoint.

Nevertheless, FocalPoint successfully advanced MacMines to become one of the very few Australian projects to take the de-SPAC route in the past two years.

This not only demonstrates FocalPoint’s depth in cross-border mining capital markets, SEC disclosure compliance, and Australian mining-tenement restructuring, but also suggests that FocalPoint is opening a more feasible, replicable, and globally capital-attractive listing pathway for Australian resources companies.

05 Special Thanks

FocalPoint extends special thanks to the following professional institutions for their strong support and close cooperation in this cross-border mining de-SPAC project, enabling the BCA to be signed in a very short period:

Pantages’ legal advisors

-

Pillsbury Winthrop Shaw Pittman (U.S.)

-

Robinson+Cole (U.S.)

-

McCullough Robertson (Australia)

MacMines’ legal advisors

-

Winston & Strawn LLP (U.S.)

-

Harney Westwood & Riegels (Cayman)

-

Clayton Utz (Australia)

They provided professional, efficient, and critical support across cross-border legal coordination, mining-tenement transfer documentation, compliant disclosure, and BCA documentation.

As a leading cross-border investment bank, FocalPoint ranks among market leaders by SPAC sponsorship count and de-SPAC transaction scale, and will continue to create more cross-border capital-markets success stories with additional partners.

In 2024, Fupeng International has successfully completed five SPAC listings, setting an annual record for a single institution in the industry.

Enterprises with clear listing plans can contact Fupeng International for negotiation. With our cutting-edge capital structure design capabilities, we help innovative enterprises seize the historic opportunities in the SPAC 2.0 era.