Against the backdrop of gradually improving global capital-market confidence, Harvard Ave Acquisition Corporation (“HAVA”), sponsored by FocalPoint Partners, has successfully completed its initial public offering (IPO) and listed on the Nasdaq Global Market, raising US$145 million in gross proceeds.

Picture: HAVA IPO press release; Source: GlobalNewswire.

As the largest SPAC sponsored by FocalPoint to date, HAVA’s offering is designed to provide greater flexibility and capital capacity for a future merger with a high-potential target—supporting companies with strong growth curves and valuation-upsides to achieve step-change development.

01 Overview of Harvard Ave Acquisition Corporation

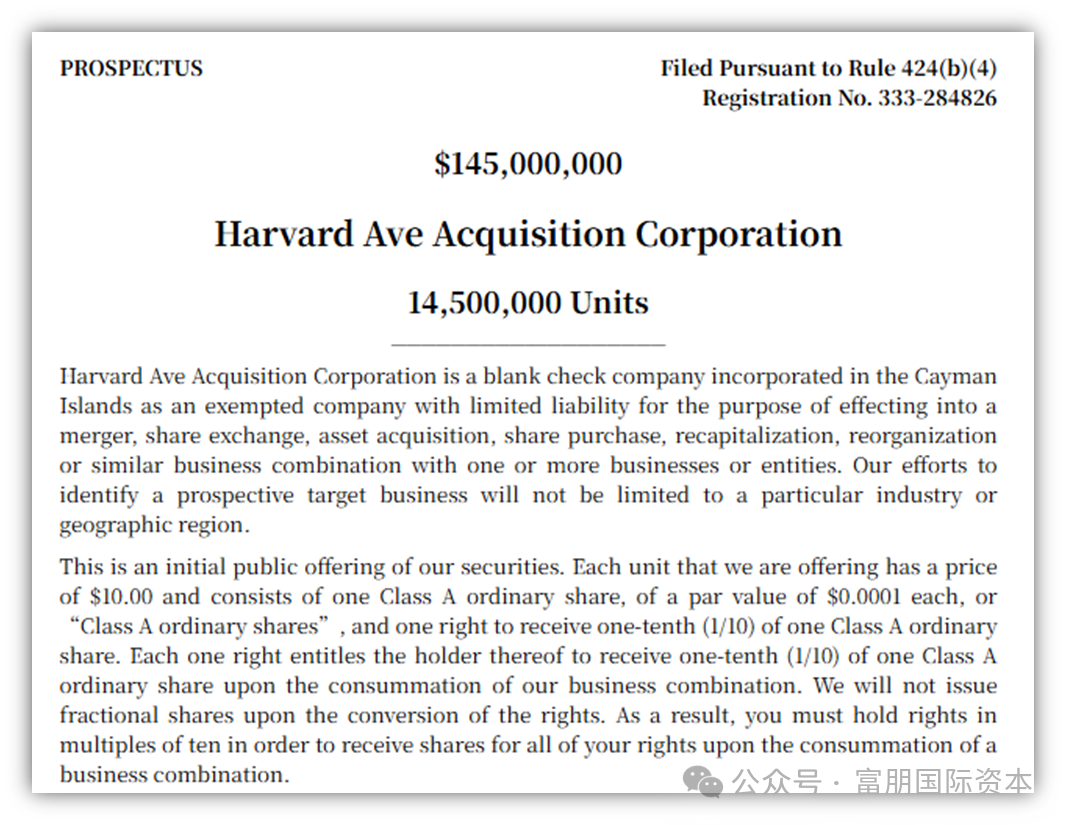

On October 24, 2025, Harvard Ave Acquisition Corporation successfully completed its IPO and began trading on the Nasdaq Global Market (Nasdaq) under the ticker “HAVAU.” This IPO issued 14,500,000 units at US$10.00 per unit, for a total raise of US$145,000,000. Each unit consists of one Class A ordinary share and one right. Each right entitles the holder, upon completion of the initial business combination (de-SPAC), to receive one-tenth (1/10) of a Class A ordinary share.

Picture: HAVA prospectus; Source: SEC.

Picture: HAVA prospectus; Source: SEC.

For this transaction, D. Boral Capital LLC served as underwriter and sole bookrunner; Robinson & Cole LLP served as U.S. counsel to the company; Winston & Strawn LLP served as U.S. counsel to D. Boral Capital LLC; Calabrese Consulting LLC provided financial administration; and MaloneBailey, LLP served as independent auditor. We extend our thanks to all professional teams for their support and close cooperation throughout the process.

02 Key Highlights of Harvard Ave Acquisition Corporation

1️⃣ Scale leadership — US$145 million offering demonstrates professional capability and market trust

Harvard’s offering size of US$145 million places it among the larger transactions in today’s market. A larger raise not only affords greater financial strength and flexibility in selecting a target company, but also signals strong market confidence in FocalPoint’s execution and professional standards.

2️⃣ “Syndicate Deal” innovative structure — efficient roadshows and a joint-investment approach showcase strength

Prior to listing, our team conducted 15+ investor roadshows with well-known Wall Street institutions, hedge funds, and family offices, successfully raising approximately US$2 million of risk capital for the project.

Through this syndicated investment approach, the actual shell-formation cost borne by the sponsors to launch a US$145 million SPAC was approximately US$1.5 million, materially reducing the economic burden of sponsorship. At the same time, costs were shared across investors, diluting per-investor sponsor cost and creating greater potential return for all participants.

3️⃣ Structure optimization — balanced scale and controlled dilution via high-quality unit design

At today’s SPAC market size, US$145 million balances capital attractiveness with combination flexibility. Harvard’s unit comprises one Class A share + one-tenth right (1/10), which keeps de-SPAC dilution minimal and creates a more competitive setup for investors and the target company. The design also balances investor returns with PIPE capacity in the combination phase, aligning with prevailing preferences for high-quality SPACs.

4️⃣ Cross-border team coordination — global configuration enhances post-merger potential

Harvard’s management and independent directors come from multiple countries and diverse backgrounds: the CEO and CFO have Korean fund and cross-border investment experience; the independent board brings expertise in investor relations, fund management, and international capital markets.

This diversity enables broader industry and geographic coverage in sourcing and executing the de-SPAC, and provides advantages in PIPE investor access, deal intermediation, and cross-border integration.

The opening-bell ceremony for Harvard Ave Acquisition Corporation will be held at a later date. The image below shows a ringing-the-bell scene from one of FocalPoint’s SPAC projects that successfully listed on Nasdaq in 2024.

Picture: One of FocalPoint’s 2024 SPAC projects ringing the bell on Nasdaq. Source: FocalPoint.

03 SPAC Market Recovery and Rebuilding Investor Confidence

Recently, as capital markets refocus on high-growth and technology-innovation companies, the SPAC market is entering a new recovery cycle. SPACs with high-quality sponsors and clear investment themes are once again attracting institutional investors, and fundraising momentum has visibly improved.

HAVA’s successful listing occurred against this backdrop, reflecting strong capital-market recognition of FocalPoint’s professional capabilities and target-selection strategy.

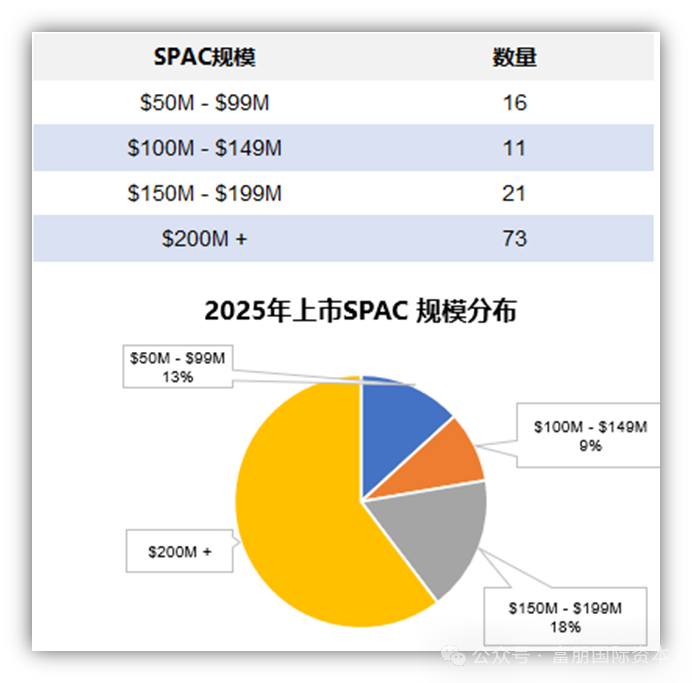

Pictured: Distribution of SPAC issuance sizes in 2025. Source: FocalPoint.

According to the chart, overall issuance size of newly listed SPACs in 2025 has risen significantly, with a notable shift toward larger deals. SPACs raising over US$200 million account for ~60% of issuance, while mid-sized SPACs (US$150–200 million) represent ~18%.

Compared with prior years—when small-to-mid transactions dominated—this move toward the top tier signals several market shifts:

-

Institutional investors are returning — more capital is flowing to larger SPACs backed by professional sponsors, clear strategies, and international backgrounds;

-

Market confidence is recovering — investors are re-acknowledging the value of SPACs as efficient listing vehicles;

-

Target expectations are higher — larger raises equip SPACs to combine with higher-growth, higher-valuation companies.

Overall, the 2025 SPAC market is characterized by greater scale, higher quality, and improving confidence, indicating that the SPAC channel’s vitality is being re-released.

04 Target Direction: Future Opportunities in AI and Crypto Assets

HAVA will focus on high-quality companies with long-term growth potential and innovative capabilities, without restricting itself to a specific industry. The team will prioritize companies that demonstrate technological innovation, scalable business models, global expansion, or sustainable growth.

In parallel, HAVA closely tracks structural opportunities in emerging fields, such as:

-

Artificial Intelligence (AI): including compute infrastructure, AI-driven industrial applications, and intelligent technology innovation;

-

Crypto Assets & Digital Infrastructure: including foundational blockchain technologies, crypto payment systems, and innovations across the Web3 ecosystem.

FocalPoint believes that any company—regardless of sector—with a clear development path and global potential merits long-term investment and support.

Leveraging FocalPoint’s deep resources and cross-border experience across the U.S. and Asia, HAVA will help globally competitive companies enter the international capital markets.

05 Conclusion

The successful listing of Harvard Ave Acquisition Corporation on Nasdaq marks the completion of the first stage of the project. This is not only a realized outcome but also a new starting point. Our core goal is to identify high-potential, globally minded companies, complete the de-SPAC transaction, and—through the power of capital markets—support these companies in listing in the U.S. and advancing global development.

This reflects FocalPoint’s consistent philosophy: connecting innovative enterprises with international capital through professional capability and disciplined execution.

In 2024, Fupeng International has successfully completed five SPAC listings, setting an annual record for a single institution in the industry.

Enterprises with clear listing plans can contact Fupeng International for negotiation. With our cutting-edge capital structure design capabilities, we help innovative enterprises seize the historic opportunities in the SPAC 2.0 era.