The picture shows the co-chairman of the US law firm Loeb & Loeb LLP speaking at the SPAC Conference 2025 which just ended in West Chester, New York on June 17-18.

01 A dramatic reversal is taking place

The picture shows the 2022 star Stormy Daniels appearing at The SPAC Conference 2022, but the venue was still deserted

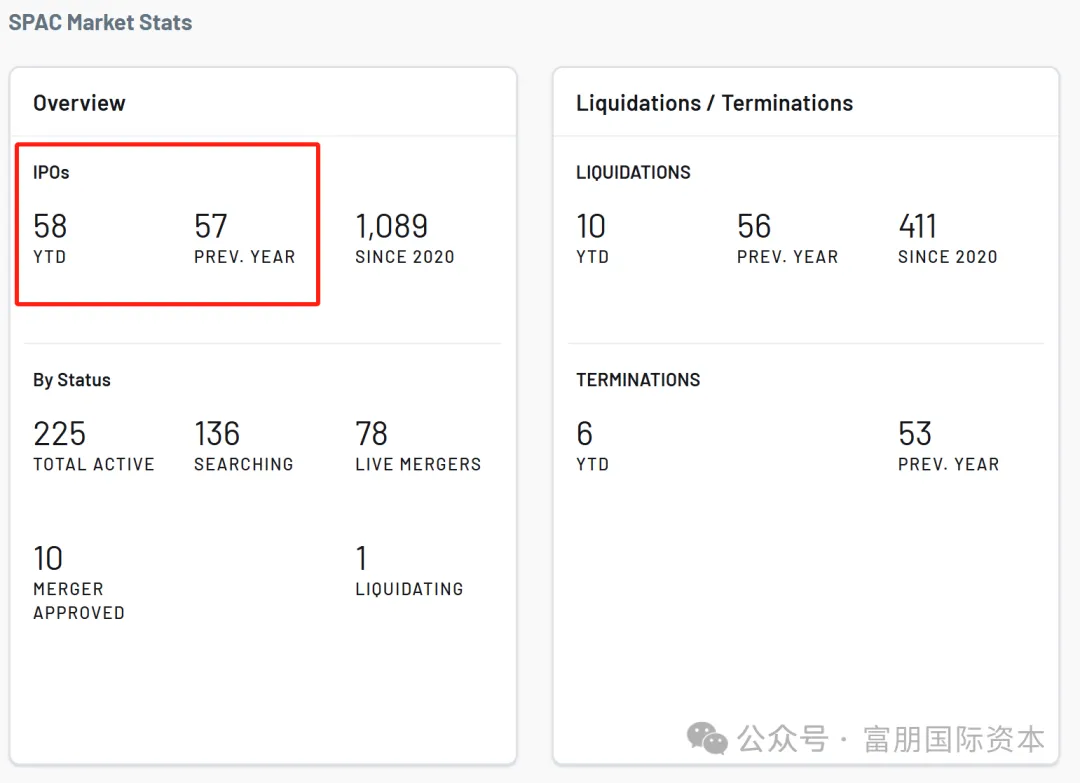

Four years ago, when even celebrities couldn’t save the SPAC (special purpose acquisition company) market from decline, no one could have imagined that this “capital magic” would make a comeback. The data doesn’t lie: In the first half of 2025, the US SPAC financing amount exceeded 10 billion US dollars, which is equivalent to the total for the whole year of 2024. However, the traditional IPO market continues to freeze under the shadow of the tariff war.

The picture shows the statistics of Listing Track 2025. The number of SPAC IPOs in the first half of the year has exceeded the number of last year.

The SPAC market has made a comeback this year, and Wall Street capitalists have also become active. Goldman Sachs announced its return to SPAC underwriting business, and giants such as JPMorgan Chase are also gearing up. What ignited investors’ enthusiasm was the statement made by “SPAC King” Chamath Palihapitiya on social media:

“Should I launch a SPAC?…I got calls from many Wall Street and Crypto Titans yesterday. They all want in and their vote matters so … I will probably do it”

Chamath said that Wall Street and crypto giants have called him to participate in his new SPAC, and he is ready to return to the market. He also said that SPAC is more transparent than traditional IPOs, and cited the recent example of the surge in the price of stablecoin Circle after its IPO, implying that traditional investment banks used IPOs to “give away $3 billion that should have been raised for IPO-listed companies to their connections.”

02 Regulatory relaxation opens the floodgates

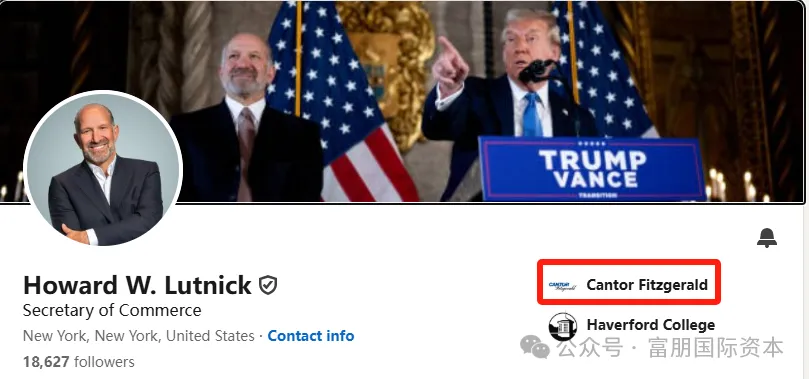

After the Trump administration relaxed financial regulation, institutional investors who had left due to Biden’s policies quietly returned. Goldman Sachs and other major banks were reported to have ended their three-year wait-and-see attitude and returned to the SPAC underwriting battlefield. The promotion of all this is inseparable from the figure of Howard W. Lutnick, the current US Secretary of Commerce.

The picture shows the Linkedin interface of Howard W. Lutnick, the current U.S. Secretary of Commerce. Before serving as the U.S. Secretary of Commerce, he served as the CEO of Cantor Fitzgerald, a well-known Wall Street SPAC underwriter, for decades.

When Lutnick is sworn in as Commerce Secretary in January 2025, his Cantor legacy will be in full swing:

- Both referee and player: Cantor not only underwrites a large number of SPAC projects, but also personally acts as a SPAC sponsor. Its “CF Acquisition” series of SPACs are searching for acquisition targets in the capital market, putting private companies into capital shells. This means that Lutnick’s old company is making money on both ends of the transaction at the same time – earning underwriting fees and taking “dry stock” rewards from SPAC sponsors.

- The timely relief of regulatory relaxation: After the Trump administration came to power, regulation of the financial market was significantly withdrawn. The strict rules of the SEC (U.S. Securities and Exchange Commission) that once made big banks avoid them, especially the litigation risks regarding SPAC merger disclosure responsibilities, have disappeared under the “non-intervention” policy. Although the Ministry of Commerce headed by Lutnick does not directly regulate SPACs, the policy direction it represents has sent a clear signal to Wall Street: Let it go!

- “The President’s Same Style” Capital Operation: More symbolically, Trump’s own media empire, Trump Media & Technology Group (TMTG, which operates Truth Social), went public through a SPAC merger last year (NASDAQ: DJT). The president himself demonstrated the “magic use” of SPAC, giving the entire industry a layer of “political correctness”.

03 Efficiency Revolution: A Breaker of Traditional IPO

“The King of SPAC” Chamath Palihapitiya pointed out the core advantage of SPAC early on: breaking through the pricing dilemma of traditional IPOs.

Pictured is SPAC king Chamath (second from right) at his new Tequila launch event as he prepares to re-enter the SPAC market to launch a new SPAC

Going public through a SPAC merger:

-

Companies can lock in valuations in advance (e.g. Trump Media Company TMTG landed on the Nasdaq stock market through SPAC with the ticker DJT) -

Compared with IPO, the average listing period is shortened by 6 months -

New economy companies that lack financing channels such as enterprises have access to fast financing channels

“We are no longer chasing flying cars,” said Joel Rubinstein, partner of the well-known law firm White & Case, at a roundtable forum, emphasizing SPAC-related regulations, “Strict due diligence + cash flow verification has become the new norm.” At the just-concluded SPAC conference, the organizers set up a special discussion on “target screening algorithms” for the first time, and a Deloitte spokesperson launched a SPAC financial health rating system. The SPAC industry self-discipline system is becoming more and more perfect.

At the same time, data shows that the funds deposited in SPAC trust accounts have reached 84 billion US dollars, and more and more “smart money” is being precisely injected through PIPE (private equity investment).

With the improvement of the SPAC listing industry system and the influx of a large amount of funds, US SPAC listings will usher in a new wave in 2025.

So far in 2024, Fupeng International has successfully completed five SPAC listings, setting an annual record for a single institution in the industry.

Enterprises with clear listing plans can contact Fupeng International for negotiation. With our cutting-edge capital structure design capabilities, we help innovative enterprises seize the historic opportunities in the SPAC 2.0 era.

Seeking opportunities to list on the U.S. stock market? FocalPoint Asia is your trusted partner