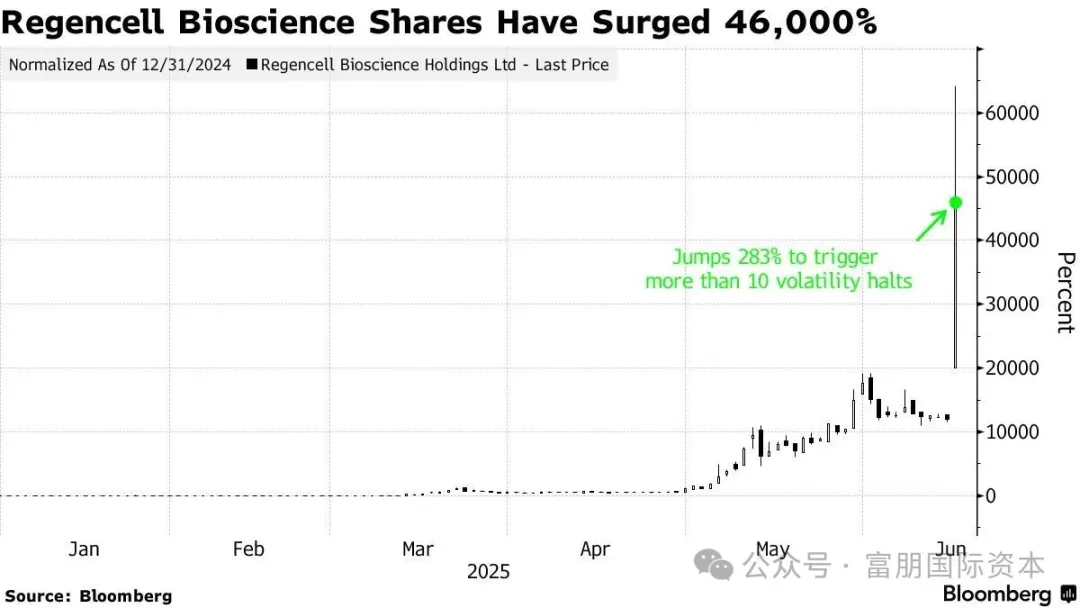

01 The subversive logic behind absurd data

- Zero revenue myth: The company’s financial report shows that it has never generated any sales revenue since its establishment, and it suffered a net loss of US$4.4 million in fiscal year 2024.

- Traditional Chinese Medicine Breaking the Wall: The core research and development direction is to use pure natural Chinese medicine compound to treat ADHD (attention deficit hyperactivity disorder) and autism, claiming that “there are no synthetic ingredients”.

- Doubts about the COVID-19 trial: In 2022, it claimed to eliminate COVID-19 symptoms in 6 days (the data has not been peer-reviewed)

Behind the seemingly crazy capital narrative is the market’s extreme bet on two major gaps: the unknown area of brain science + traditional wisdom that has not been verified by modern medicine.

02 The “Tesla Moment” of Modern Chinese Medicine

When Musk used brain-computer interfaces to challenge neurological diseases, Regencell chose a more “Eastern” path:

“All our drug candidates are based on traditional Chinese medicine theory, and natural ingredients constitute a complete biological system”

-Regencell Bioscience SEC filing original text

And this just hits the two points favored by capital:

1. Disruptive technological imagination: Using ancient prescriptions to deconstruct neurological diseases that modern medicine is helpless against

2. Policy expectations: China’s “14th Five-Year Plan” clearly supports scientific and technological innovation in traditional Chinese medicine

Although the company admitted that it “has no patents, no sales capabilities, and may never make a profit,” capital has declared with a 46,000% increase: in the face of a disruptive story, reality can temporarily withdraw.

03 The capital code behind the surge

1. The ultimate chip game:

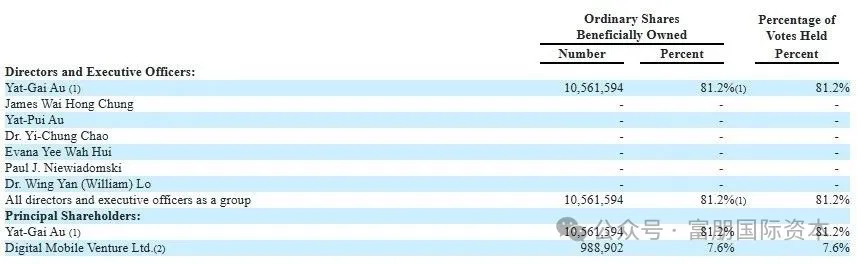

- Circulating shares only account for 6% of total shares (Apple 98%, Tesla 87%)

- CEO Yat-Gai Au personally holds 81.2% of shares

- After the 38:1 stock split in July, the stock price soared 283% in a single day

The picture shows the equity structure of Regencell Bioscience. Source: SEC filing

2. “China Narrative” Premium:

When biotech encountered a capital winter, TCM concepts became a new outlet. According to Bloomberg data, the average increase of the “traditional medicine” sector in the US stock market will reach 340% in 2025.

3. A hotbed of retail speculation:

After the stock split, the price per share is less than $5, and the proportion of retail transactions soars to 63% (only 17% in 2024)

04 A Song of Ice and Fire in Modern Chinese Medicine

This carnival hides warnings:

⚠️ Lack of scientific verification: All drugs are in the preclinical stage and have not applied for any regulatory approval

⚠️ Valuation bubble flaw: 30 billion market value is equivalent to 3 Tong Ren Tang, but Tong Ren Tang’s annual revenue exceeds 20 billion

⚠️ Cultural discount risk: FDA has never approved compound Chinese medicine to treat neurological diseases

But the deeper revelation lies in:

✅ Capital recognizes with real money: the modern transformation of traditional medicine contains trillion-level opportunities

✅ The path of modernization of traditional Chinese medicine with “clear ingredients-clear mechanism-evidence-based verification” urgently needs to be broken through

✅ Chinese pharmaceutical companies need to seize the discourse power of “telling the story of traditional Chinese medicine in scientific language”

Regencell’s crazy curves are like a prism:

- Reflects capital’s desire for breakthrough innovation

- Reflecting the potential breakthrough of traditional Chinese medicine in the field of neuroscience

- It also indicates that the integration of biotechnology and traditional medicine has reached a critical point

Perhaps in the next decade, what truly changes the rules of the game is not the speculative myth of a 460-fold surge, but the Chinese laboratory that transforms berberine into an Alzheimer’s drug.

Seeking opportunities to list on the U.S. stock market? FocalPoint Asia is your trusted partner