On December 8 and 9, 2025 (Beijing time), the crypto capital market witnessed two milestone moments. ProCap Financial (Nasdaq: BRR) and Twenty One Capital (NYSE: XXI) completed back-to-back de-SPAC transactions and were successfully listed on U.S. exchanges, becoming the first two Bitcoin Treasury Companies in history to go public in the United States via a merger with a SPAC.

Picture: Far right in the photo is Anthony Pompliano; his Bitcoin treasury company ProCap Financial completed its de-SPAC listing on December 8. Source: CoinDesk.

This transaction became almost a mirror of an era — at the very height of the SPAC frenzy, a Wall Street titan stepped in personally and created the largest SPAC in history. Years later, as the tide receded and SPACs normalized, the summit Ackman raised still sits at the top of the curve like a permanent marker.

Behind that peak lies a story of ambition, innovation, gamesmanship — and regret.

01 What is a Bitcoin Treasury Company?

Put simply, it is a company that treats bitcoin as its core asset.

Its business models typically include three categories:

-

Holding a large amount of bitcoin as the core of the balance sheet (akin to a “digital-gold treasury”).

-

Conducting financial businesses around bitcoin such as lending, trading, and capital-markets services.

-

Allowing traditional investors to gain indirect bitcoin exposure via the company’s equity.

The most typical example is bitcoin enthusiast Michael Saylor’s Strategy (Nasdaq: MSTR), which has transformed itself into “the world’s largest publicly listed bitcoin-holding entity” by continuously issuing bonds and new shares.

Picture:As shown in the image is Michael Saylor, who often posts AI-generated images of himself and crypto on social media to show his support for bitcoin; Source: Twitter @saylor.

What makes ProCap Financial and Twenty One Capital noteworthy is that—

All previous Bitcoin treasury companies, including Strategy, achieved their status via “business reorganization” or “listed-company transformation.” No Bitcoin treasury company had ever directly listed via a traditional IPO or a de-SPAC before.

02 Why are ProCap and Twenty One important?

Because they are the first and second in history to:

-

Submit SEC filings under the identity of a “Bitcoin Treasury Company”;

-

Conduct accounting and disclosure with bitcoin as the core asset structure;

-

Obtain SEC approval and list via de-SPAC.

This is a fundamental breakthrough: for the first time, the SEC has accepted a Bitcoin Treasury Company as “a business model eligible for listing.”

It not only means regulators have, for the first time, acknowledged that bitcoin can be the core asset on a company’s balance sheet with listing legitimacy, but also suggests that more companies may enter traditional capital markets using the SPAC + Bitcoin Treasury model in the future.

By this point, the capital market had sent an unprecedented signal:

-

The SEC no longer regards “bitcoin as the core asset” as a model that constitutes an obstacle to listing.

-

Bitcoin Treasury may be becoming part of mainstream listing pathways.

-

The integration of digital assets and traditional capital markets has entered a new stage.

ProCap Financial and Twenty One Capital are not merely two newly listed companies; what they symbolize is that Bitcoin Treasury Companies have crossed the regulatory threshold and entered a “compliant listing era.”

03 Twenty One Capital: Whose company is it?

Twenty One Capital was founded by Jack Mallers, founder and CEO of real-time bitcoin payments app Strike, one of the few entrepreneurs in crypto with “cultural-icon-level” influence.

Picture:Photo of Jack Mallers; Source: Nasdaq.

-

He is the founder and CEO of Strike.

Strike is one of the earliest U.S. apps to use the Lightning Network to promote real-time bitcoin payments. -

He was one of the key figures promoting El Salvador’s adoption of bitcoin as legal tender.

Mallers’ speech directly influenced President Nayib Bukele’s decision. -

He is called a “native evangelist of Bitcoin.”

He appears on CNBC, Bloomberg, and at U.S. Congressional hearings. -

He has cooperated with mainstream companies such as Twitter and Shopify to promote bitcoin payments.

He represents one of the youngest and most compelling generations of entrepreneurs in the bitcoin ecosystem.

In popular narratives, Twenty One Capital has brand power and topicality because of Mallers.

The SPAC (special purpose acquisition company) merging with Twenty One is also notable.

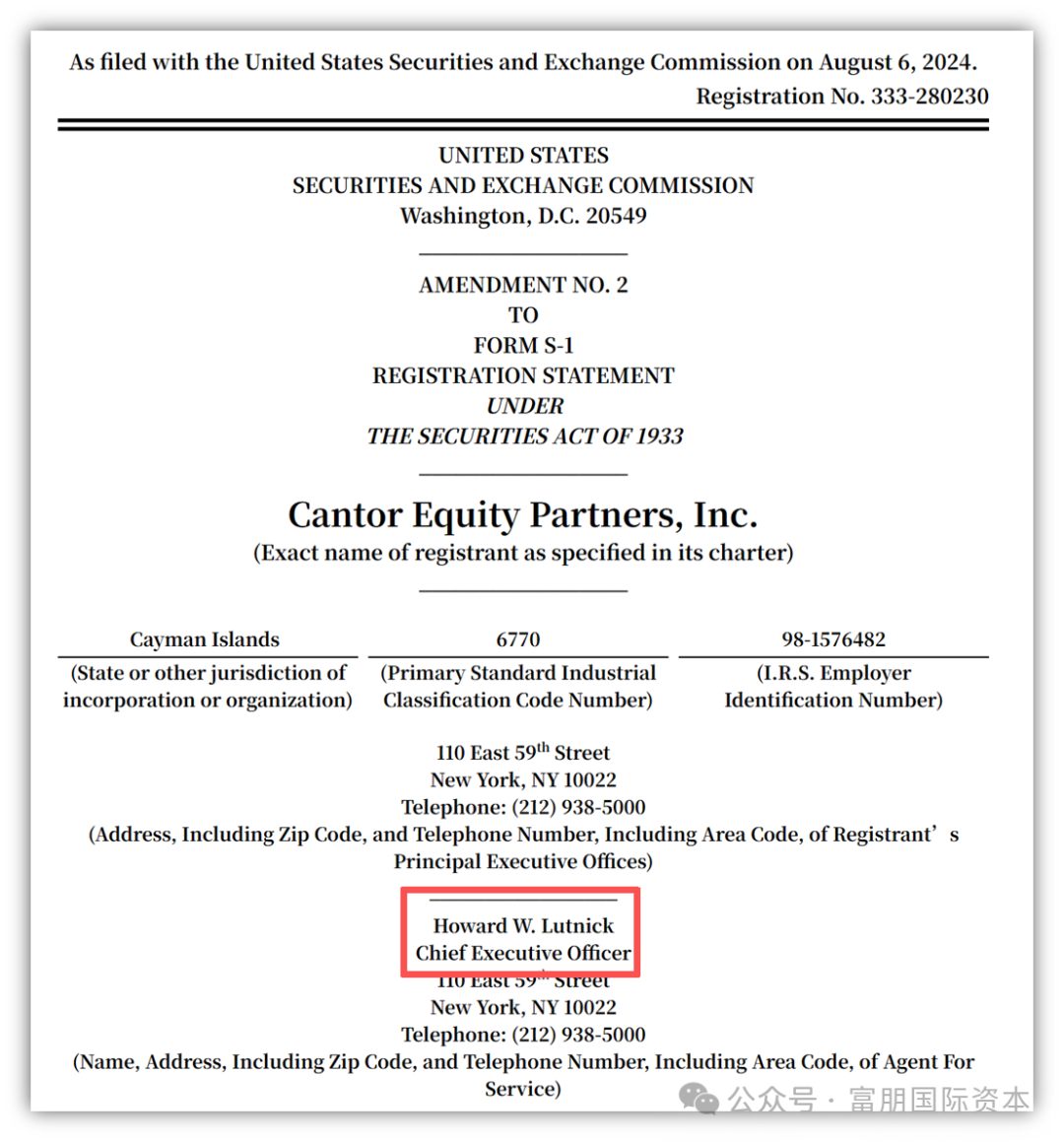

Twenty One completed its de-SPAC listing via Cantor Equity Partners, Inc. (NasdaqGM: CEP), a SPAC under investment bank Cantor Fitzgerald. The SPAC’s sponsor is Howard Lutnick, the current U.S. Secretary of Commerce.

Picture:Image at right shows Howard Lutnick, current Secretary of Commerce; Source: NYT.

Picture:Shown is the prospectus of NasdaqGM: CEP; Howard Lutnick serves as the SPAC’s CEO. Source: SEC.

With a high-profile crypto figure plus a Commerce Secretary who bridges politics and business, Twenty One Capital’s success hardly seems accidental.

04 Twenty One: Truly owned by Tether

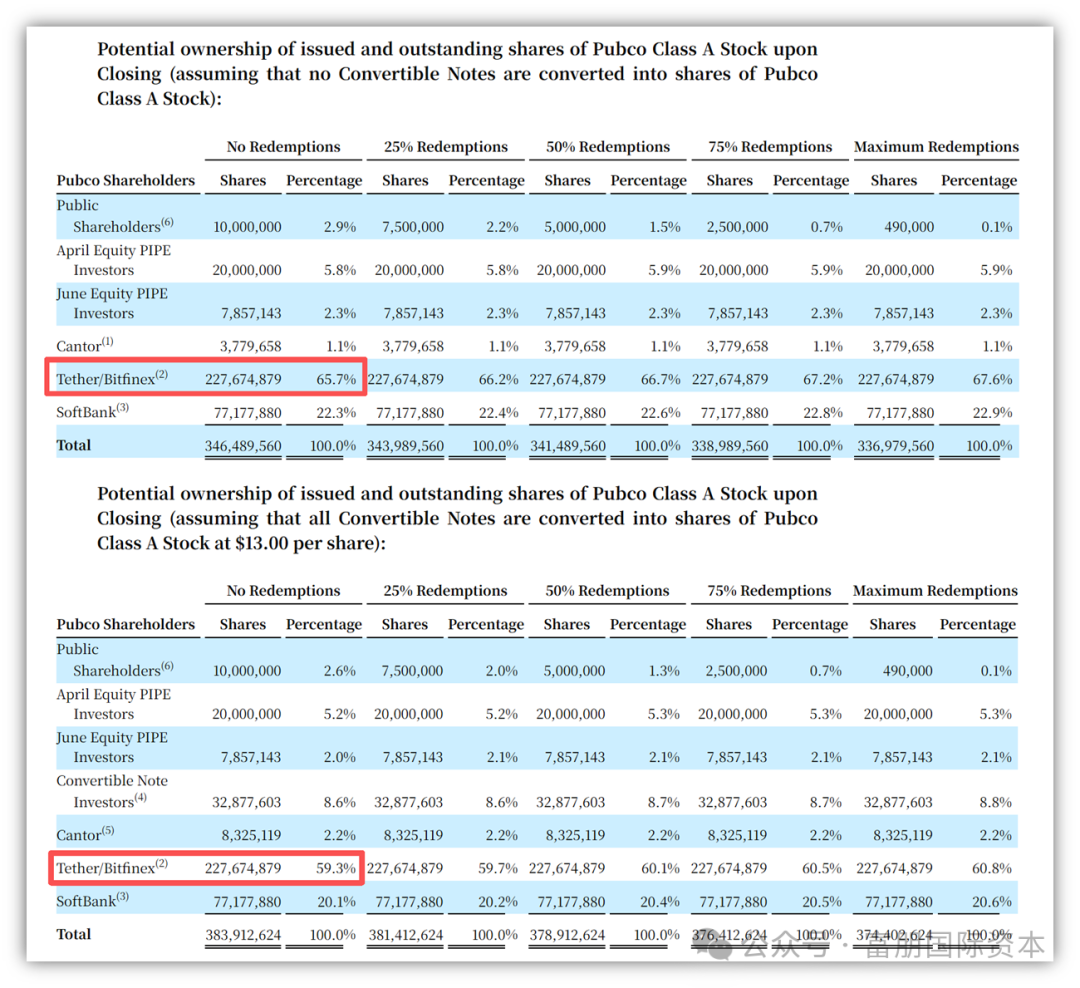

If Twenty One Capital is a “bitcoin aircraft carrier,” then the one truly at the helm is neither Jack Mallers nor the SPAC sponsor Cantor, but Tether (the parent company that issues USDT) and its affiliates.

Image: Twenty One Capital’s F-4 filing; with or without conversion of the convertible notes, Tether would be the largest shareholder. Source: SEC.

Why can Tether be the “real boss”? The key is: the bitcoin was also purchased and injected by Tether.

This arrangement has two parts: PIPE Bitcoin and Contribution Bitcoin.

1) PIPE Bitcoin: Use PIPE funds to help PubCo purchase at least 10,500 BTC

At the time of signing the BCA, Tether, PubCo, and SoftBank signed a series of Bitcoin Sale and Purchase Agreements, setting out what is called the “PIPE Bitcoin Sale.”

The basic logic:

-

The listing vehicle obtains hundreds of millions of dollars in cash through three PIPEs (convertible-note PIPE + April equity PIPE + June equity PIPE).

-

Tether uses this cash to purchase BTC in the market in batches.

-

These purchased BTC are then sold back to the listing vehicle at closing based on “net proceeds raised.”

-

If the Initial + Option quantities total less than 10,500 BTC, Tether must purchase additional “Additional PIPE Bitcoin” to make up the shortfall and then, at closing, contribute that BTC in exchange for shares in the listing vehicle.

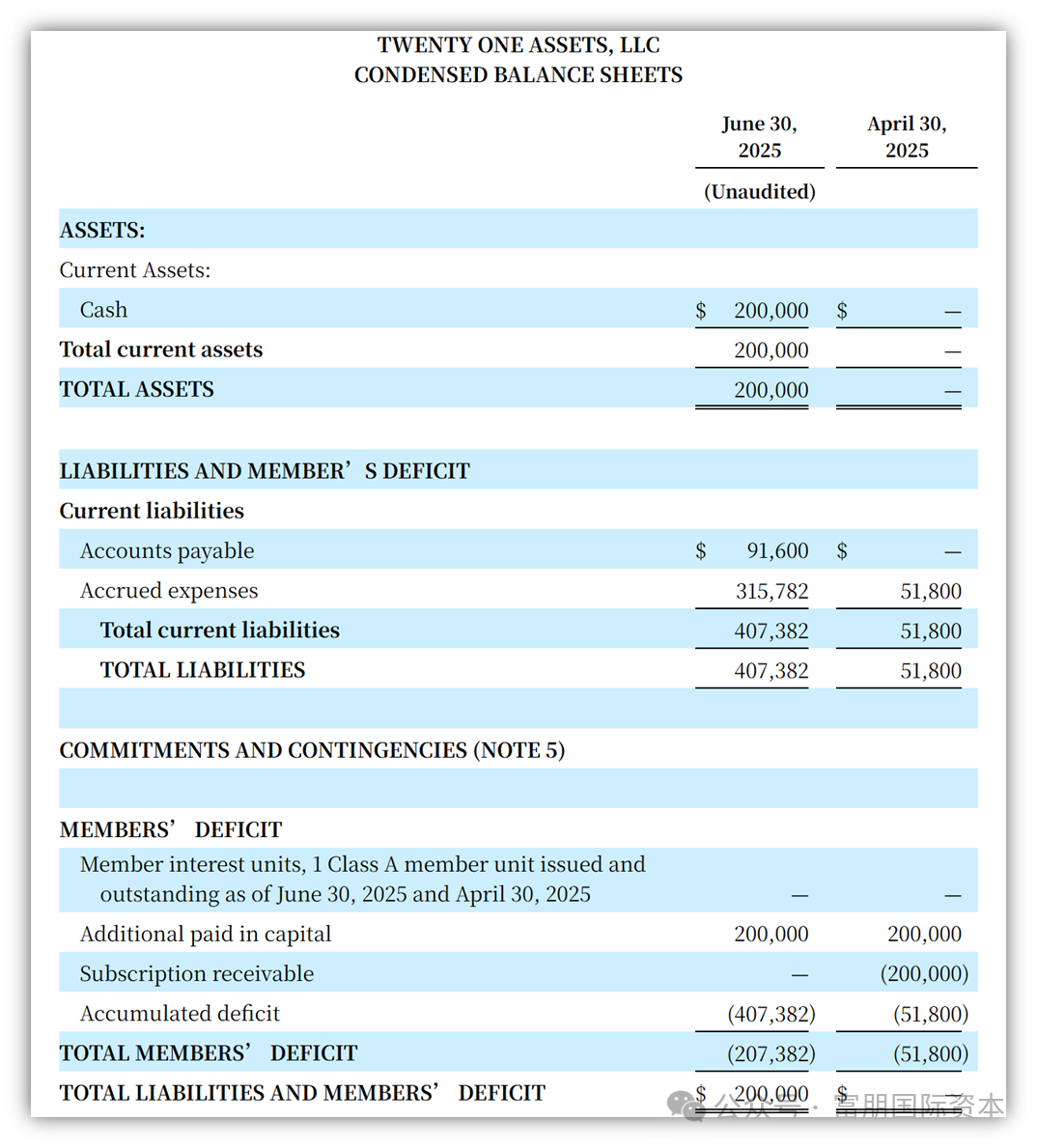

Image:Shown are Twenty One Capital’s pre-listing financials; apart from US$200,000 in registered capital, the company was essentially an empty shell. Source: SEC.

2) Contribution Agreement (Capital Contribution): Tether + Bitfinex directly “injected” 31,500 BTC into Twenty One.

-

Before closing, Tether contributed 24,500 BTC to Twenty One.

-

Bitfinex contributed 7,000 BTC to Twenty One.

-

As consideration, the two received Company Class A & B Interests in Twenty One.

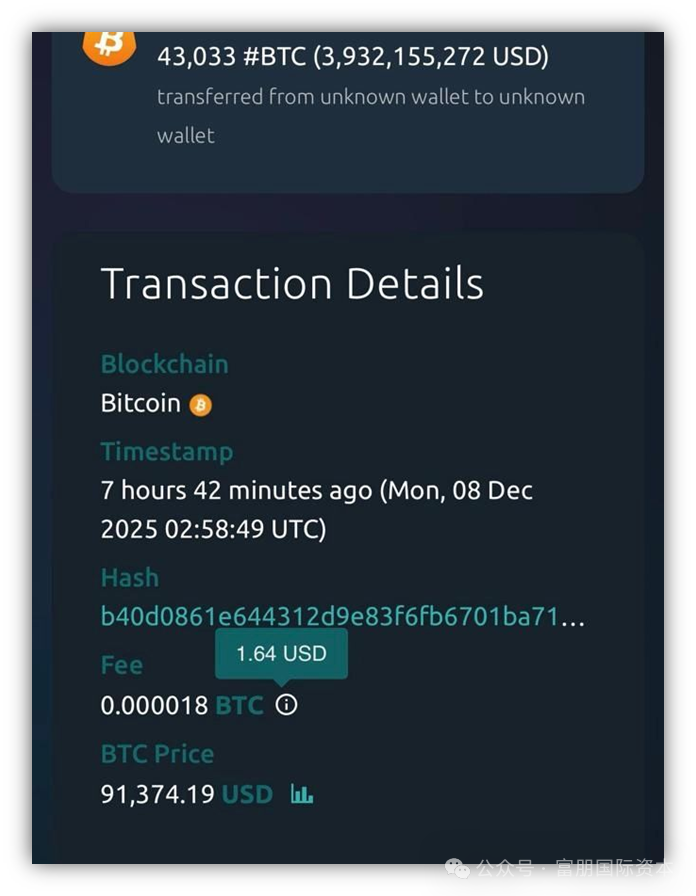

This 31,500 BTC, when added to PIPE Bitcoin (≥10,500), means the listed-company structure ultimately held about 43,500 BTC. From start to finish, these >40,000 BTC were not purchased by Mallers and certainly not by the sponsor; they were contributed by Tether + Bitfinex and purchased under Tether’s direction.

From an asset perspective:

The “treasury” of Twenty One is essentially Tether’s system packaging its own BTC into a U.S. listed shell.

Image:A netizen spotted the transfer of more than 40,000 BTC related to the Twenty One merger; the transaction fee was only US$1.64. Source: LinkedIn.

05 ProCap Financial: A more conventional listing path

If Twenty One Capital is an example where Tether injects assets and controls voting power, then ProCap Financial represents another, more conventional Bitcoin Treasury listing path that will likely become more common in the future: an institutionalized BTC-treasury model funded by institutional investors, operated by a professional asset-management team, and taken public by a Wall Street SPAC.

Founder Anthony Pompliano: A figure straddling Wall Street and crypto

Picture: Anthony Pompliano being interviewed by CNBC on Bitcoin treasury companies; Source: CNBC.

Anthony “Pomp” Pompliano is one of the best-known voices in crypto, but a more accurate description is: an entrepreneur who understands markets, a fund manager who understands capital, and a media figure who understands narrative.

His background is highly diverse:

-

Co-founder of Morgan Creek Digital — manages multiple funds focused on digital assets and blockchain infrastructure; LPs include institutional investors, family offices, and foundations.

-

Early investor in crypto companies — including Coinbase, BlockFi, HDD infrastructure, etc.

-

Extensive institutional network — able to raise hundreds of millions of dollars of institutional capital in a short time (ProCap’s US$516.5 million institutional private placement is a representative example).

-

One of the most influential communicators in the U.S. crypto market — the Pomp Podcast has millions of subscribers; guests have included:

Mark Cuban (owner of the NBA’s Dallas Mavericks)

Cathie Wood (founder of ARK Invest)

Brian Armstrong (founder of Coinbase)

Jack Mallers (founder of Strike)

and even former U.S. government officials.

The SPAC merging with ProCap: Columbus Circle Capital (BRR)

This SPAC is itself noteworthy, a typical combination of “Wall Street pedigree + global network.”

-

CEO Gary Quin is Vice Chairman of Cohen & Company (investment bank).

-

An independent director is Dr. Adam Back, inventor of Hashcash and the only cryptography pioneer cited in the Bitcoin whitepaper.

(Dr. Adam Back’s own Bitcoin treasury company is also in the de-SPAC process and is merging with a SPAC whose CEO is the son of the U.S. Secretary of Commerce, Lutnick.)

Picture:Dr. Adam Back, whose research laid the groundwork for bitcoin and who was once suspected of being Satoshi Nakamoto; Source: Bloomberg.

06 ProCap Financial: Listing with crypto assets in hand

Compared with Twenty One Capital, ProCap Financial’s listing path shows a breakthrough with greater regulatory significance.

When Twenty One Capital signed the BCA, the company’s balance sheet had virtually no assets.

Its Bitcoin treasury came from Tether, Bitfinex, and PIPE Bitcoin — BTC that was injected into the target on the very day of closing.

In other words, Twenty One only “loaded” bitcoin assets at the moment the de-SPAC closed. Before listing, it was an “asset-light operating entity,” and only at listing did it become a true Bitcoin Treasury through a package asset injection.

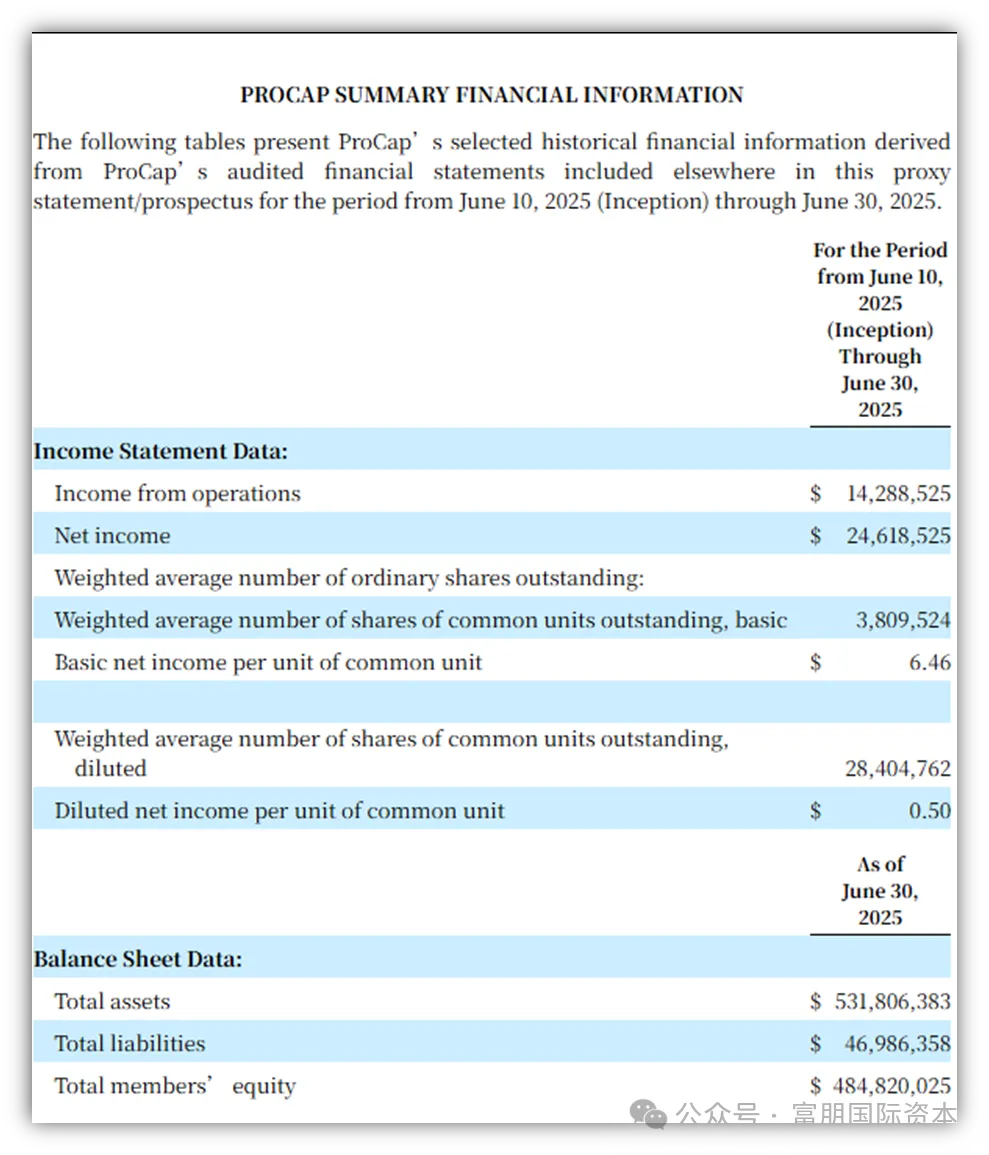

ProCap Financial was completely different.

ProCap already held crypto assets on its balance sheet before the merger.

On June 23, 2025, the same day it signed the BCA, ProCap completed a US$516.5 million institutional private placement and used the proceeds to purchase bitcoin. These BTC had already been booked, ownership confirmed, undergone audit procedures, and were presented as assets in ProCap’s pre-combination financial statements.

This means:

Before merging with the SPAC, ProCap was already a genuine Bitcoin Treasury company, not an “empty-load company” waiting to receive assets after closing.

This is also the first time the industry has seen:

-

-

Large-scale bitcoin assets

-

Booked before the merger

-

Capable of passing audit

-

Included as target-company assets in the F-4 financials

-

Picture: ProCap Financial’s financial statements; over US$530 million in assets were on the books prior to listing. Source: SEC.

ProCap has proven a key point: bitcoin assets can be audited, accepted by regulators, and incorporated into the U.S. listing system:

-

Bitcoin can be formally recorded as a company asset

(under U.S. GAAP as “long-lived assets / fair-value change” treatment) -

Auditors can complete audit procedures

(including on-chain ownership verification, cold-wallet custody evidence, audit trail) -

It can form part of the consideration in a SPAC merger

(explicitly disclosed in the F-4) -

It is possible to “bring assets” directly into the SEC review system and U.S. capital markets

This differs from past market perceptions:

-

Can crypto assets be audited?

-

Can crypto assets be included in a listed company’s financial statements?

-

Can crypto assets be recognized in the SEC review process?

ProCap’s de-SPAC has given the market its first large-scale, institutional, and formal answer — Yes. Moreover, it can be done compliantly, transparently, and verifiably.

In 2024, Fupeng International has successfully completed five SPAC listings, setting an annual record for a single institution in the industry.

Enterprises with clear listing plans can contact Fupeng International for negotiation. With our cutting-edge capital structure design capabilities, we help innovative enterprises seize the historic opportunities in the SPAC 2.0 era.