Launched in October 2021, the FocalPoint SPAC Fund focuses on SPAC arbitrage, PIPE investments, and structured financing across global capital markets. The mandate combines low-risk arbitrage with select, high-conviction structured opportunities to safeguard principal while capturing theme-driven upside.

01 Performance Highlights

-

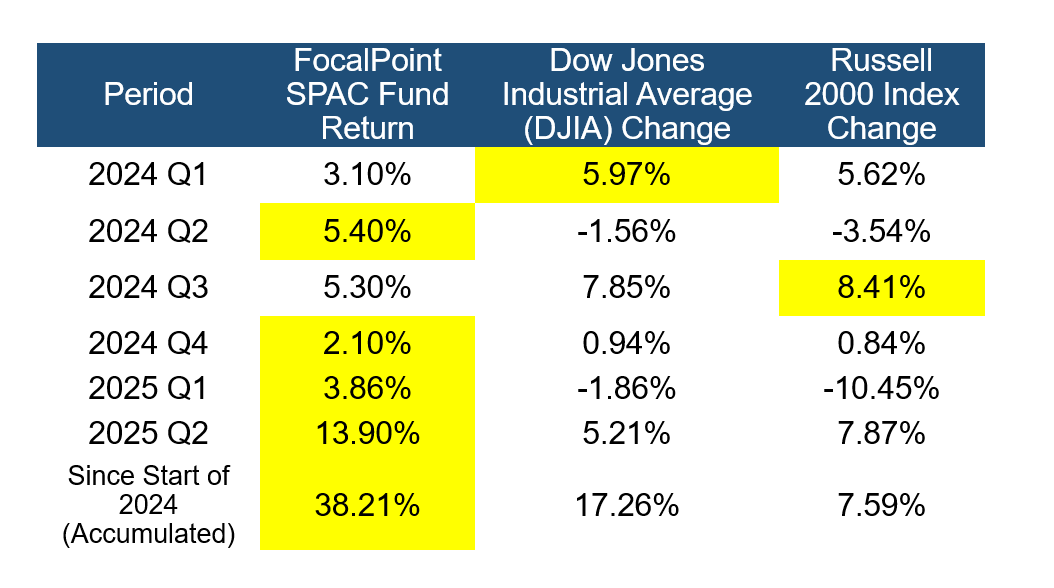

Q2 2025 return: +13.9%

-

YTD (from early 2024): +38.2%

-

Since inception (Oct 2021): +51.7%

Against a complex macro backdrop and divergent risk appetite, the Fund continued to demonstrate capital preservation with steady compounding.

Pictured: Since early 2024, the FocalPoint SPAC Fund has generally outpaced the benchmarks. Cumulative return from the start of 2024 stands at 38.21%.

Pictured: Since early 2024, the FocalPoint SPAC Fund has generally outpaced the benchmarks. Cumulative return from the start of 2024 stands at 38.21%.

02 “Fixed-Income++” in Practice

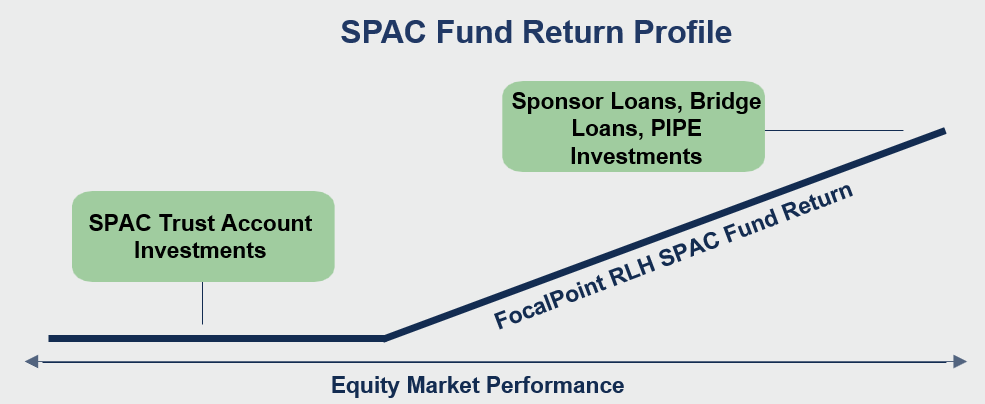

- Fixed-income core. The majority of capital is allocated to SPAC trust accounts that primarily invest in U.S. Treasuries, offering investment-grade safety and liquidity. If a transaction does not close, investors can redeem principal and collect T-bill interest, forming a base of “principal protection + interest income.”

- Equity-style upside. On top of this floor, the Fund selectively deploys warrants, PIPEs, and bridge/other structured positions to participate in equity appreciation. Example: in H1 2025, an airline-group IPO contributed a >300% project-level return.

Pictured: FocalPoint SPAC Fund return profile—fixed-income core for downside protection, structured financing for high-conviction excess returns.

Pictured: FocalPoint SPAC Fund return profile—fixed-income core for downside protection, structured financing for high-conviction excess returns.

- Asymmetric profile. During softer markets, the redemption mechanism underpins stability; when thematic exposures (e.g., AI, crypto assets, defense technology) are re-rated, the strategy captures high-certainty excess returns.

- This combination of fixed-income safety and equity growth has supported the cumulative +51.7% return since launch, outpacing U.S. equities and bonds over the same period.

03 Market Outlook: SPACs Enter a New Cycle

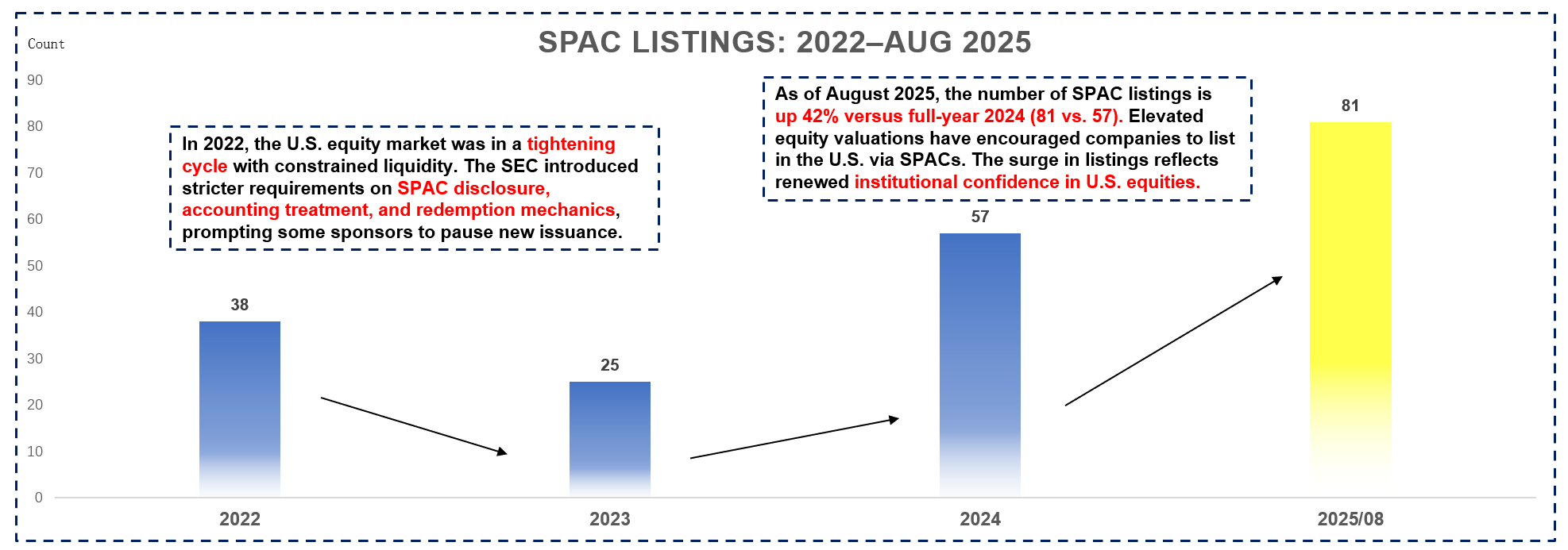

1) Activity re-accelerating.

- Year-to-date 2025 has seen higher SPAC IPO and de-SPAC counts than the same period in 2024.

- Themes around AI, defense technology, and crypto finance are reviving, with PIPE volumes gradually recovering.

- Investor confidence is returning, particularly toward targets with credible growth and clear cash-flow visibility.

Pictured: Change in the number of U.S. SPAC listings: a breakout surge in 2025.

Pictured: Change in the number of U.S. SPAC listings: a breakout surge in 2025.

2) Sharper structures.

Increased use of Forward Purchase Agreements (FPAs), structured PIPEs, and tiered redemption mechanisms is helping to mitigate redemption risk, positioning SPACs as an efficient financing-plus-M&A instrument rather than merely “shells.”

3) Policy backdrop stabilizing.

U.S. regulators are emphasizing transparency in disclosure rather than over-restricting issuance. The uncertainty seen in 2023–2024 has largely been absorbed, improving policy visibility for market participants.

4) Opportunities and challenges.

As the Fed’s easing cycle lowers funding costs, a new wave of business combinations is plausible. Over the next two years, mid-cap technology and crypto-related assets are expected to feature prominently. The return of PIPE capital suggests institutions are again considering SPACs within alternative allocations.

Summary (H2 2025):

De-risked market (lower redemptions, PIPEs warming) ·

Clear themes (AI, defense, crypto, energy) ·

More predictable policy (clearer investment playbooks). In this environment, the Fund’s

“Fixed-Income++” approach is positioned to preserve a margin of safety via the trust-asset base while selectively capturing equity upside from the cyclical recovery in SPACs.

In 2024, Fupeng International has successfully completed five SPAC listings, setting an annual record for a single institution in the industry.

Enterprises with clear listing plans can contact Fupeng International for negotiation. With our cutting-edge capital structure design capabilities, we help innovative enterprises seize the historic opportunities in the SPAC 2.0 era.