On August 4, 2025, New America Acquisition I Corp., a special purpose acquisition company (SPAC) targeting U.S. manufacturing businesses, filed a Form S-1 with the U.S. Securities and Exchange Commission (SEC) to list on the New York Stock Exchange (NYSE). The filing immediately made front-page news—the reason: the SPAC is controlled by the Trump family.

01 Who’s involved in the Trump family’s SPAC?

According to the publicly filed S-1, New America Acquisition I Corp. disclosed its sponsor structure and key transaction terms. The SPAC seeks to raise $300 million on the NYSE and aims to complete a business combination within 24 months. Each publicly offered unit comprises one Class A ordinary share and one-half of a redeemable warrant.

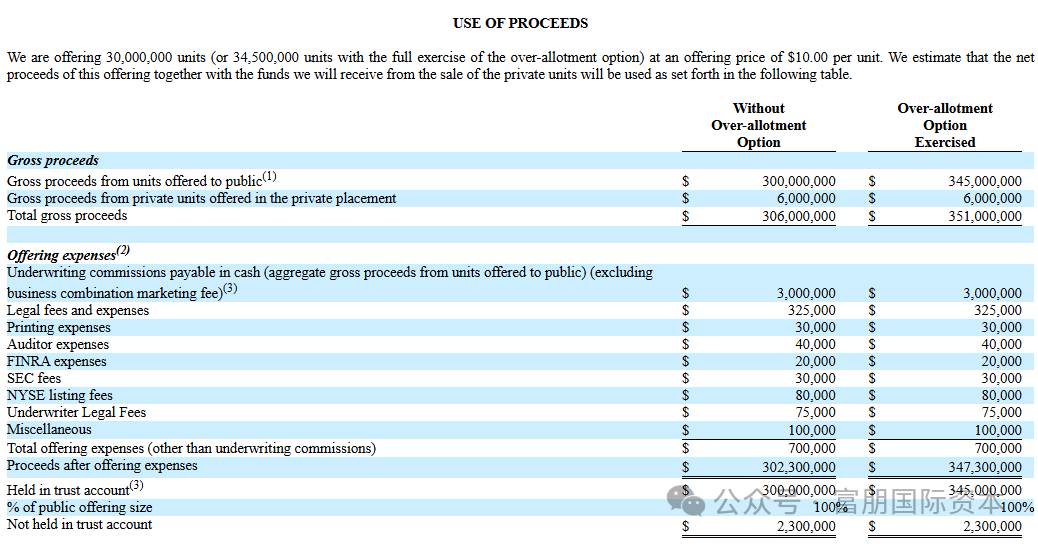

Pictured: The use-of-proceeds table indicates approximately $6 million in formation (SPAC) costs, with about $2.3 million budgeted for third-party services such as legal and audit.

Pictured: The use-of-proceeds table indicates approximately $6 million in formation (SPAC) costs, with about $2.3 million budgeted for third-party services such as legal and audit.

Deal participants and advisors include:

-

Underwriters: D. Boral Capital and Dominari Securities

-

Underwriters’ Counsel: Ellenoff Grossman & Schole LLP

-

U.S. Legal Counsel: Paul Hastings LLP and Holland & Knight LLP

-

Auditor: MaloneBailey LLP

Both Dominari and D. Boral have long-standing ties with the Trump family.

-

Dominari Securities, headquartered in Trump Tower (New York), counts Eric Trump and Donald Trump Jr. as members of its advisory board. The Trump brothers joined the advisory board of Dominari Holdings in February and participated in its private placement, owning roughly 6.7%—a stake that could rise to about 10% upon full warrant exercise. Following related announcements, Dominari’s share price at one point surged ~400%.

pictured: Dominari announcement appointing Donald J. Trump Jr. and Eric Trump to the advisory board.

pictured: Dominari announcement appointing Donald J. Trump Jr. and Eric Trump to the advisory board.

- D. Boral, a New York boutique investment bank focused on SPACs, assisted in 2022 when Trump Media & Technology Group (NasdaqGM: DJT) went public via a SPAC.

Sponsor team

-

Kevin McGurn, Chief Executive Officer & Chief Financial Officer

Pictured:Kevin McGurn during a media interview.

Pictured:Kevin McGurn during a media interview.

McGurn brings extensive senior-management experience across media and technology. He served as President of Sales & Distribution at the digital music platform Vevo, leading global expansion strategy, and held multiple senior sales and marketing roles at T-Mobile, driving the integration of digital content with telecom operations. Before entering the SPAC arena, he briefly served as CEO of Triller Group, spearheading the public-market transition of TikTok’s U.S. competitor.

- Kyle Wool, Advisor

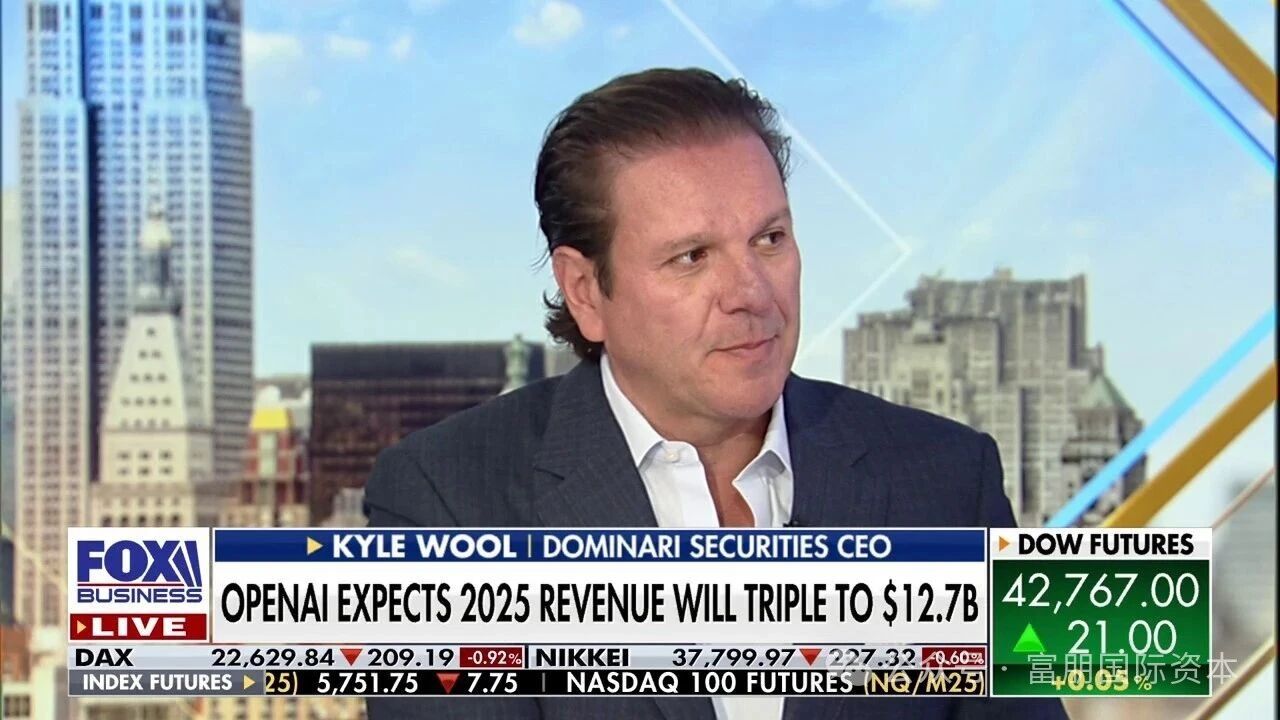

Pictured:Kyle Wool on a Fox morning markets program.

Pictured:Kyle Wool on a Fox morning markets program.

Wool is President of Dominari Holdings Inc. and CEO of Dominari Securities. In partnership with the Trump brothers earlier this year, Dominari helped form American Data Centers Inc., focused on AI data-center infrastructure, in which Dominari holds roughly 32%. Wool has stated that the Trump family’s involvement helps advance the project’s AI and data-center strategy.

02 SPAC — the President’s preferred path to list

In U.S. capital markets, a SPAC offers a “fast lane” distinct from the traditional IPO. The mechanism is straightforward: a shell company first lists (SPAC IPO), then completes a business combination within two years to take an operating company public (de-SPAC).

Compared with the traditional IPO—often lengthy, tightly regulated, and exposed to pricing volatility—the SPAC route can provide greater valuation certainty and timeline flexibility for the target, while granting the sponsor a meaningful promote as incentive. This high-leverage, fast-paced path aligns with the Trump style—direct, brand-driven, and valuation-focused.

“DJT” lands on Nasdaq (2022) Pictured: Promotional poster for Trump Media & Technology Group—a company affiliated with President Donald J. Trump—at the time of its public listing.

Pictured: Promotional poster for Trump Media & Technology Group—a company affiliated with President Donald J. Trump—at the time of its public listing.

The Trump family’s affinity for SPACs is no accident. In 2022, former President Trump took his social-media venture public via SPAC: Trump Media & Technology Group (TMTG), the parent of Truth Social. TMTG and Digital World Acquisition Corp. (DWAC) completed their merger in March 2024, and the ticker was changed to the symbol packed with symbolism: DJT, abbreviating Donald J. Trump.

The deal drew intense market attention:

-

On debut, DJT shares jumped more than 50%, and the company’s market capitalization at one point topped $10 billion;

-

Although TMTG’s revenues remained modest, Trump’s personal brand and political mobilization created a faith-driven bid among retail investors;

-

The transaction solidified Trump’s status as a paper billionaire through his stake, adding momentum—financially and symbolically—to his 2024 presidential run.

This successful case shows that SPACs are an important financial tool within the Trump business playbook; it also suggests that SPAC regulation under a Trump administration is unlikely to tighten. It further signals that other family members (e.g., Donald Jr. and Eric Trump) may continue to expand their footprint via SPACs—New America Acquisition I being the latest example after DJT.

And note the Roman numeral “I” in the name: that typically implies a series, making it likely that additional SPACs will follow. Listing via SPACs on U.S. exchanges is becoming a mainstream path.

In 2024, Fupeng International has successfully completed five SPAC listings, setting an annual record for a single institution in the industry.

Enterprises with clear listing plans can contact Fupeng International for negotiation. With our cutting-edge capital structure design capabilities, we help innovative enterprises seize the historic opportunities in the SPAC 2.0 era.